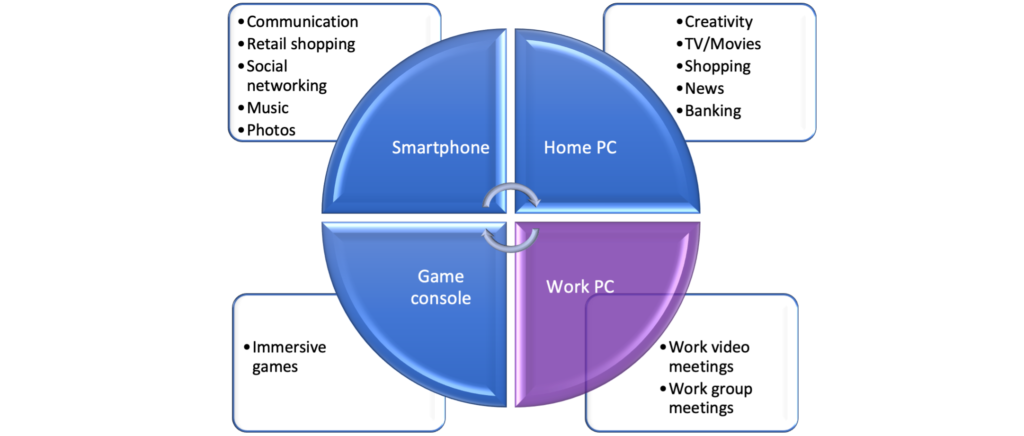

Worldwide, smartphones have grown to be the primary device used the most by nearly half of online adults. Among American adults, PC usage continues to lead, although the gap has narrowed.

Activities for PCs versus smartphones

Dan Ness, Principal Analyst, MetaFacts, September 13, 2021

Which device gets chosen for which activities?

Penetration of key devices among remote workers [TUPdate]

Many employees working from home need connected devices to work or to communicate. This TUPdate reports on the collection of actively used connected devices, comparing what is being used by employees working from home, employees not working from home, and adults not employed outside the home. These are split by form factor as well as operating system family.

Work from home experience & plans [TUPdate]

Employees who have had prior experience working from home have different and more intense technology purchase plans than those who are new to working from home or that have never worked from home. This TUPdate identifies purchase plans for a selection of home office products among employees comparing their previous experience working from home.

iPhone and Android smartphone purchase plans [TUPdate]

Fifty percent more online Americans plan to buy an iPhone than an Android smartphone.

Demographics profile of smartphone users [MetaFAQs]

While smartphone adoption has grown to dominance, market penetration has not been equal across all demographic groups. This MetaFAQs reports on the penetration of active smartphone use by employment status, age group, and work-from-home status for the US and globally (US, Germany, UK, Japan, China-upper-educated).

Students and their technology

College students are visible users of technology devices. During the pandemic, their collection of actively used devices has shifted slightly. Worldwide, Windows PCs are the leading device followed by iPhones, which are reaching more students. Among Americans, Apple OS devices top the list, partly due to broader iPhone penetration.

Personal devices get the work done [MetaFAQs]

Employees use personally owned home PCs for work. Well before the pandemic, this has been a widespread practice. This MetaFAQs reports on the work-related activities done with home PCs among employees that work from home and those that do not. It also compares home PC activities from the 1987 wave of TUP.

Shifts in Apple and Windows penetration among Americans [MetaFAQs]

Apple’s PC/Mac penetration has grown while Windows has shrunk. Globally, iPhone penetration has grown as Androids have subsided – both have been stable among online Americans. Globally, iPad penetration has withdrawn as have non-Apple tablets.

Smartphones evolve into primacy [TUPdate]

Smartphones are above the 50% mark for nearly every type of activity and for being used for the most activities within that type. Worldwide, over half of users mostly use a smartphone for communications, social networking, shopping, and graphics/imaging. PCs still form a primary platform for many shopping activities.