Smartphones have rapidly, although not completely, replaced feature phones. Smartphone users have expanded their range of activities with new uses while also increasingly migrating activities from computers and tablets. This TUP Highlights Report profiles smartphones – their market penetration, user demographic profile, regular activities, usage profile, key competitors, and purchase plans.

This TUP Highlights report includes the following sections: penetration of smartphones versus feature phones, smartphone brand share, top activities for smartphones, smartphone carrier share, smartphone usage profile, trends in technology ecosystems, major activities for a market segment, and the profile of smartphone users.

User profile by operating system ecosystem

Dan Ness, Principal Analyst, MetaFacts, October 13, 2021

Apple for youngest adults and Windows for the middle

- Windows has the broadest overall market penetration of any OS family

- Globally, Windows is strongest among adults who are employed, in larger households, working from home, and neither the oldest nor youngest

- Apple OS devices have their strongest market penetration among younger adults, especially those employed and working from home

- Apple’s global market penetration is supported in three ways: iPhones, Macs, and iPads

- The global penetration of Google OS devices is primarily supported by Android smartphones.

User profile by technology ecosystem

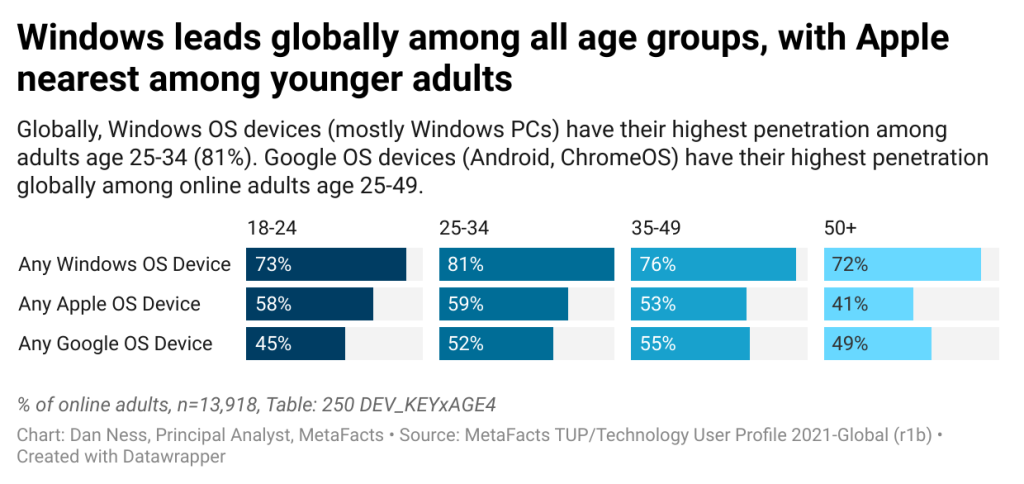

The major technology ecosystems have each captured different market segments. This TUP MetaFAQs report details the current market penetration of Windows, Apple OS devices, and Google OS devices by age group, and work-from-home status within the US and across the US, UK, Germany, and Japan.

Technology ecosystem device penetration by country, age, and employment status

One measure of an ecosystem’s breadth is its market penetration. This MetaFAQs splits out the percentage of online adults using major OS families and form factors – such as Windows PCs and iPhones – by country and by age and employment status.

Windows leads what Apple and Google divide [MetaFAQs]

Windows, Apple, and Google (Android, Chromebook) are each stronger or weaker by form factor and country. This MetaFAQs reports on the share of each OS ecosystem by country and within the US, by age group.

Key ecosystems penetration [MetaFAQs]

The market penetration of Windows OS, Apple OS, and Google OS devices varies considerably by country. This MetaFAQs reports on each OS ecosystem’s active market penetration and splits out American users by age group.

Profile of Apple’s active base

Apple’s customers with many Apple OS devices (iPhones, iPads, Macs) have a higher than average socioeconomic profile and use of connected devices.

Samsung laptop progress [TUPdate]

While Samsung may be well known for its smartphones, Android tablets, and even refrigerators, its other devices–like PCs–have not achieved such notoriety. However, they are making strides to keep up with the competition—namely Apple.

This TUPdate reports on penetration rates between Samsung and Apple across countries, within their respective user bases, among their smartphone users, by age group, and technology ecosystem. This report measures online adults in the US, Germany, the UK, Japan, and China from TUP/Technology User Profile 2020, which is TUP’s 38th annual. It also includes data from TUP 2018 and 2019.

Samsung and Apple users by age group and country [MetaFAQs]

Age may be just a number, but a user’s age can tell us a lot about their preferences—especially between top competitors Samsung and Apple. Since each company is striving to expand its core base beyond smartphones to more PCs/Macs and tablets, it’s worth noting that there is a distinct difference in market penetration by age group.

This MetaFAQs details the device-type penetration of Samsung and Apple’s smartphones, PCs, and tablets by age group in 2020 in the US, UK, Germany, and China.

Samsung and Apple’s device type penetration within core [MetaFAQs]

The competition is fierce between Samsung and Apple. Both companies have the strongest hold of the smartphone market, and they are now trying to expand this across device types—especially within their pre-existing core customer base. One measure of brand loyalty is the range of device types that customers actively use.

This MetaFAQs details the device-type penetration of Samsung and Apple’s smartphones, PCs, and tablets within each of their respective core bases in 2020 in the US, UK, Germany, and China.